Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

盡管美聯儲降息預期增加,但美元依舊走高

通脹頑固,符合預期

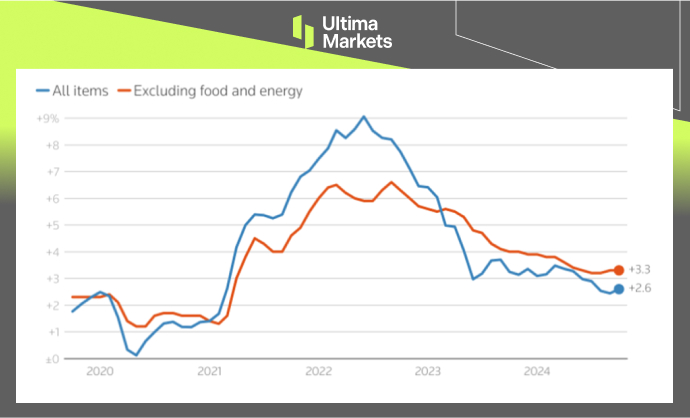

周三,美國勞工統計局公布,消費者價格指數(CPI)連續第四個月上漲0.2%,與路透社調查的經濟學家預期一致。按年率計算,10月份CPI同比上漲2.6%,高于9月份的2.4%,也符合市場預測。報告發布後,美元指數上漲0.49%,收于106.48。

(美國CPI同比和核心CPI同比圖表,來源:LSEG)

(DXY日線價格圖表,來源:Trading View)

CPI數據,特別是12個月通脹率的上升,表明盡管市場普遍預期美聯儲將在12月會議上降息25個基點,但持續的高通脹可能會促使美聯儲在2025年重新評估其寬松步伐。自9月份以來,美聯儲已累計降息一個百分點。

報告發布後,根據CME集團的FedWatch工具,交易員對12月份降息25個基點的概率預期上升至82%,高于周一的58.7%。盡管部分美聯儲官員態度更為謹慎,明尼阿波利斯聯儲主席尼爾·卡什卡利在接受彭博電視采訪時表示,他有信心通脹正處于下行軌道,並指出CPI數據證實了這一趨勢。

然而,重大不確定性依然存在,特別是在選舉後可能發生的政策變動下。市場正在對未來政策方向做出大量假設,但在未來一到兩年內的實際情況仍然未知。

免責聲明

本文所含評論、新聞、研究、分析、價格及其他資料僅供參考,旨在幫助讀者了解市場形勢,並不構成投資建議。Ultima Markets已采取合理措施確保資料的准確性,但不能保證資料的絕對准確性,並可能隨時更改,恕不另行通知。Ultima Markets對于因直接或間接使用或依賴此類資料而可能導致的任何損失或虧損(包括但不限于利潤損失)不承擔責任。

隨時隨地留意市場動態

市場易受供求關系變化的影響

對關注價格波動的投資者極具吸引力

流動性兼顧深度與多元化,無隱藏費用

無對賭模式,不重新報價

通過 Equinix NY4 服務器實現指令快速執行