Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomUS-China Talk Hope Reignited, US Services PMI Falls

On April 23, 2025, the US and China appear to be entering a potential new phase of negotiation, with President Trump expressing optimism about reaching a deal that could lead to a substantial reduction in tariffs on Chinese imports.

However, the renewed optimism remains limited, as the US S&P Global Services PMI declined in April and came in below expectations.

Trump Softens on Tariffs, Signals Trade Talks

In a statement on Tuesday, President Trump acknowledged the severity of the current tariffs and announced his plan to “substantially” reduce them, while clarifying that they will not be eliminated entirely. Some tariffs will remain in place depending on China’s response in the upcoming trade talks.

While President Trump has publicly stated that the US is “actively” negotiating with China, US Treasury Secretary Scott Bessent clarified that no official talks have begun.

Currently, US tariffs on Chinese goods stand at 145%, with China imposing 125% tariffs on American imports. The White House is reportedly considering reducing these tariffs to a range between 50% and 65% as a goodwill gesture to ease tensions.

Although informal communications between the two countries are ongoing, no formal negotiations have been scheduled. Investors are closely monitoring developments, as the outcome of the trade dispute between the world’s two largest economies could have significant market implications.

US Services PMI Disappoints, Rising Price Raise Concerns

On the other hand, the latest S&P Global PMI data released on Wednesday points to a slowdown in U.S. business activity, which could have significant market implications.

- The S&P Flash Services PMI fell to 51.4 in April, down from 54.4 in March, indicating a cooling in the service sector.

- Meanwhile, the S&P Flash Manufacturing PMI edged slightly higher to 50.7, up from 50.2 in March.

US S&P Flash PMI Data; Source: S&P Global PMI

However, the overall Composite PMI, which combines both services and manufacturing, dropped to 51.2, down from 53.5 in March. This marks the lowest reading in 16 months, highlighting slowing momentum across the broader economy.

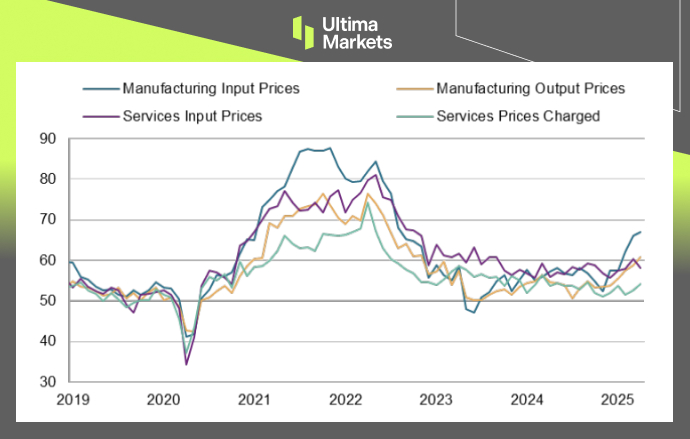

S&P Global US PMI Price Index; Source: S&P Global PMI

Meanwhile, the PMI input price indices also show the average prices charged for goods and services rose in April at the sharpest rate for 13 months, increasing especially steeply in manufacturing (where the rate of inflation hit a 29-month high) but also picking up further pace in services.

Cautious for Over-Optimism

Despite renewed optimism from potential U.S.-China trade talks, uncertainty still surrounds the U.S. economic outlook. The recent slowdown in business activity may suggest that the impact of tariffs is beginning to show, while rising prices continue to raise concerns about inflation.

SP500 Index,4-Hour Chart Analysis; Source: Ultima Market MT5

The S&P 500 gave up some of its recent gains on Tuesday, keeping the benchmark index below its key bearish territory between 5,500 and 5,440 resistance level.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server