Federal Reserve Holds Rates Steady, Cites Trade Uncertainty

TOPICSAt its May meeting, the Federal Reserve kept the federal funds rate unchanged at 4.25%–4.50%, in line with market expectations. This marks the third consecutive meeting without a rate change. The Fed maintained a similar policy stance to previous meetings, signaling a cautious and measured approach amid growing economic uncertainties.

Fed Stance & Powell’s Remarks

The Fed reiterated its “wait-and-see” approach, aiming to assess the broader economic impact of recent tariff hikes. Policymakers acknowledged rising risks of both higher inflation and weaker labor market conditions stemming from ongoing trade tensions.

Chair Jerome Powell, during the post-meeting press conference, highlighted the elevated uncertainty facing the economy:

“If the large increases in tariffs that have been announced are sustained, they’re likely to generate a rise in inflation, a slowdown in economic growth, and an increase in unemployment.”

While Powell noted that the US economy remains “solid” for now, he stressed that the full effects of recent trade policy changes are yet to be seen—warranting a cautious and flexible policy approach in the months ahead.

In addition to that, the decision to maintain the current interest rate was unanimous among the Federal Open Market Committee (FOMC) members.

Implications for Future Move

In short, the Fed is taking a “wait-and-see” approach, staying data-dependent amid ongoing uncertainty. The Fed recognizes that underlying economic risks—largely tied to trade and tariff uncertainty—remain elevated, and it prefers to remain on standby, ready to act only when conditions warrant.

Given the Fed’s emphasis on economic data, upcoming inflation and job reports will be crucial in shaping expectations for rate adjustments. Investors should closely monitor the upcoming CPI data and June’s data for signs of wage pressure or slowing job creation. Any deviation from expectations could quickly shift rate outlooks.

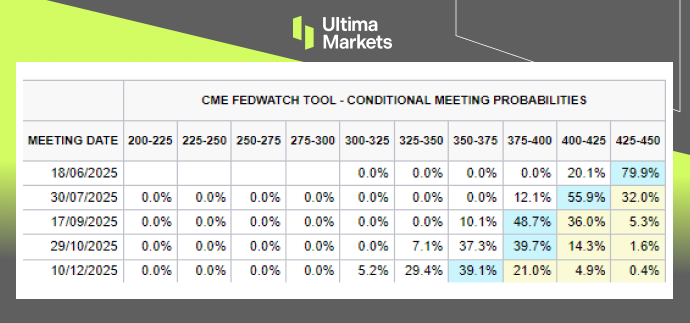

CME Fedwatch Rate probabilities; Source: CME Group

Following the Fed’s announcement, the probability of rates remaining unchanged in June rose from 69% to 79.9%, while the cut probabilities in July slightly down to 55.9%, according to the CME FedWatch tool.

Market Reaction: US Dollar Remains Range-Bound

Despite the Fed sounding slightly hawkish and signaling its readiness to act if needed, the US Dollar showed limited movement. The Dollar Index (DXY) remained range-bound between 99 and 100, suggesting the market had already priced in the Fed’s stance, with no major surprises to shift sentiment.

Dollar Index, 4-H Chart Analysis; Source: Ultima Market MT5

From a technical perspective, a clearer trend is likely to emerge only after a breakout in either direction—so keep a close watch for any decisive move.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server