Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

U.S Producer Prices Increase Less Than Expected

Fed Holds Firm Amid Slower Producer Price Growth

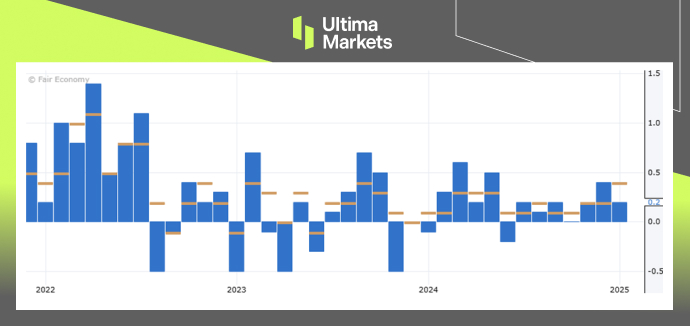

US producer prices saw a less than an expected increase in December, this increase was aided by the stable service prices that offset the rise in the goods costs. This establishes the fact that the inflation is still on a downward trend, even after certain stagnation has occurred in the months leading up to this.

The Labor Department’s Bureau of Labor Statistics has stated that the Producer Price Index (PPI) for final demand has surged by 0.2% as of December after the prediction rate reached a rate of 0.4% in November. The increase predicted by economists was 0.3%, however, these estimates were at odds with the consensus of economists.

(U.S. PPI m/m Chart, Source: Bureau of Labor Statics)

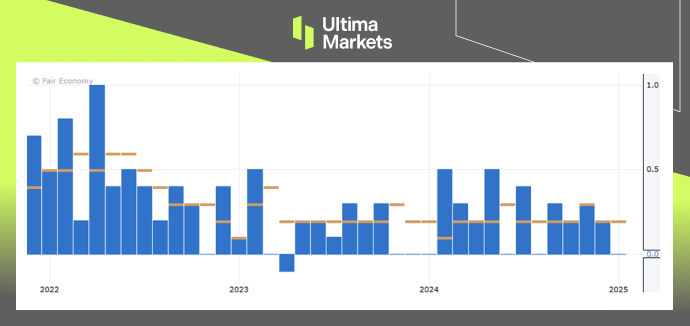

Meanwhile, the core PPI which excluding food, energy, and trade edged up by 0.1% for the second consecutive month. On an annual basis, core PPI rose 3.3%, down from 3.5% in November. However, some economists cautioned against overinterpreting December’s modest PPI increase, noting that producer prices often soften during this month.

(U.S. Core PPI m/m Chart, Source: Bureau of Labor Statics)

Despite the easing in producer inflation, reported by the Labor Department on Tuesday, expectations remain that the Federal Reserve will hold off on cutting interest rates until at least the second half of the year. This is due to a strong labor market and the potential inflationary impact of tariffs on imported goods proposed by President-elect Donald Trump’s incoming administration.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Ultima Markets에서 금속 및 원자재 거래를 하는 이유는 무엇인가요?

Ultima Markets는 전 세계적으로 널리 사용되는 원자재에 대해 가장 경쟁력 있는 비용과 거래 환경을 제공합니다.

거래 시작하기이동 중 시장 모니터링

공급과 수요의 변화에 민감한 시장

가격 투기에만 관심이 있는 투자자에게 매력적

숨겨진 수수료 없는 깊고 다양한 유동성

딜링 데스크 없음 및 재호가 없음

Equinix NY4 서버를 통한 빠른 실행