Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomUSD to CNY Forecast: 2025 Exchange Rate Trend Insights

The USD to CNY exchange rate is one of the most closely watched currency pairs in the global foreign exchange market, garnering long-term attention from investors worldwide. Against the backdrop of persistent global economic shifts, the trajectory of the USD/CNY rate remains a focal point for market analysis. This article will provide a comprehensive forecast of the USD to CNY exchange rate trend, analyze its key influencing factors, and deliver precise market insights to assist investors in formulating robust strategies for future forex trading.

1. What Is the USD/CNY Exchange Rate?

1.1 Concept of Exchange Rates

The USD/CNY exchange rate refers to the conversion ratio between the US dollar and the Chinese yuan, indicating how many yuan are required to exchange for 1 US dollar. As the currencies of two of the world’s largest economies, fluctuations in the USD/CNY rate directly impact global market volatility. Consequently, this exchange rate not only reflects the economic health of both nations but also stands as one of the most closely monitored currency pairs by forex traders and international investors.

1.2 Historical Volatility of the USD/CNY Exchange Rate

| Time Period | Exchange Rate Status | Explanation |

| 2005 | Launch of CNY exchange rate marketization reform | Began dismantling the fixed exchange rate regime, introducing market-driven adjustment mechanisms. |

| After 2008 Financial Crisis | Increased CNY exchange rate flexibility | Gradual decoupling from the USD, with expanded exchange rate fluctuation bands. |

| August 2015 | Sharp CNY depreciation | Sudden devaluation triggered global market turbulence, intensifying USD/CNY volatility. |

| March 3, 2025 | 1 USD ≈ 7.2838 CNY | CNY shows modest recovery against the USD compared to previous periods. |

| March 3, 2025 | 1 EUR ≈ 7.9085 CNY | CNY demonstrates appreciation against the EUR, indicating broader currency stabilization. |

2. Key Factors Influencing the USD/CNY Exchange Rate

2.1 U.S. Economic Conditions & Monetary Policy

The USD/CNY exchange rate is closely tied to U.S. economic performance and monetary policy. When the U.S. economy strengthens, the USD tends to appreciate, causing the CNY to depreciate against the USD. Conversely, if the U.S. economy weakens or faces inflationary pressures, the USD may depreciate, potentially leading to CNY appreciation. Notably, monetary policy actions by the Federal Reserve (Fed)—such as interest rate hikes or cuts—directly impact the USD’s value.

In 2024, the Fed’s implementation of interest rate hikes strengthened the USD, exerting downward pressure on the CNY. While the Fed’s rate decisions may drive short-term fluctuations in the USD/CNY rate, the USD’s long-term trajectory generally aligns with the U.S. economy’s fundamental performance.

2.2 China’s Economic Development & Policy

China’s economic health significantly impacts the CNY exchange rate. As the world’s second-largest economy, its GDP growth, international trade dynamics, and policy directions influence the CNY’s performance. Amid rising global economic uncertainties, investors often view the CNY as a safe-haven asset.

In 2024, the Chinese government introduced multiple policies to support economic growth, aiming to stabilize domestic markets. These measures directly shape the CNY’s trajectory, requiring investors to monitor China’s economic data and policy shifts while considering external conditions when making investment decisions.

2.3 International Trade & Global Economic Environment

International trade dynamics and shifts in the global economy significantly influence the USD/CNY exchange rate. US-China trade relations, in particular, remain a key driver of fluctuations in this currency pair. For instance, progress in the 2024 US-China trade agreement directly impacts demand for the CNY, thereby affecting the USD/CNY rate.

Global economic uncertainties—such as energy price volatility, political risks, or other international economic crises—often trigger exchange rate volatility. Investors should closely monitor developments in the global economic landscape to accurately forecast future trends in the USD/CNY exchange rate.

3. USD/CNY Exchange Rate Trend Forecast: Future Outlook and Trends

3.1 2025 USD/CNY Exchange Rate Forecast

Based on current market analysis and economic projections, the USD/CNY exchange rate is expected to remain volatile in the coming years. Due to evolving economic policies in the U.S. and China, the 2025 exchange rate may experience significant fluctuations. If the Federal Reserve continues raising interest rates in 2024, further USD appreciation could exert depreciation pressure on the CNY.

Additionally, the Chinese government is likely to advance structural reforms and financial market liberalization, which may provide support for the CNY. However, shifts in the global economic landscape—such as renewed U.S.-China trade tensions or pandemic-related disruptions—could amplify market sentiment swings, heightening exchange rate uncertainty.

3.2 How to Capitalize on Forex Market Opportunities

For forex traders, mastering USD/CNY exchange rate trends is critical. The following strategies can help seize opportunities from rate fluctuations:

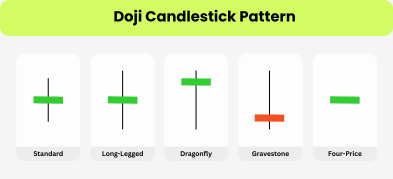

- Technical Analysis: Use chart analysis and indicators (e.g., RSI, MACD) to predict market movements and identify optimal entry/exit points.

- Fundamental Analysis: Monitor U.S. and Chinese economic data, policy shifts, and global economic developments to assess market direction.

- Risk Management: Limit risk per trade to ≤2% of total account value, implement stop-loss and take-profit orders to protect capital.

4. How to Start Trading USD/CNY on Ultima Markets

4.1 Open a Live Account and Deposit Funds

To begin trading the USD/CNY exchange rate, first open a live account on Ultima Markets. After verifying your identity and depositing funds, you can start executing trades.

4.2 Practice with a Demo Account

If you are new to forex trading, use a demo account to practice risk-free. This allows you to learn trading mechanics, familiarize yourself with market operations, and test your strategies without financial exposure.

4.3 Picking the Right Trading Tools and Strategies

Ultima Markets gives traders top-tier tools and multiple strategies to better handle USD/CNY rate swings. These tools let traders run sharper technical and fundamental analysis, so you can make smarter trading calls.

5. Frequently Asked Question FAQ

Q: How can the future trend of the USD to CNY exchange rate be predicted?

A: The movement of the USD to CNY exchange rate is influenced by multiple factors, including economic data from both the U.S. and China, international political developments, and global economic policies. By combining technical analysis with fundamental data, traders can better forecast market fluctuations and adopt appropriate investment strategies.

Q: How can risks be managed in forex trading?

A: Effective risk management is critical. By setting stop-loss and take-profit levels, appropriately utilizing leverage, and diversifying investments, traders can effectively control trading risks and avoid significant losses.

6. Conclusion

The volatility of the USD/CNY exchange rate offers numerous trading opportunities for forex investors while simultaneously presenting risks. Understanding the factors influencing USD/CNY rate movements, adopting scientific trading strategies, and maintaining disciplined risk management can help investors achieve long-term profitability in dynamic markets. Ultima Markets provides an advanced trading platform and comprehensive technical support, making it the optimal choice for entering the forex market.

For detailed insights into USD/CNY exchange rate trends or forex trading strategies, visit the Ultima Markets official website.